Institutional choice in the governance of the early Atlantic sugar trade: diasporas, markets and courts

by Daniel Strum (University of São Paulo)

This article is published by The Economic History Review, and it is available for EHS members here.

Reproduction of this image by any means is strictly prohibited.

In the age of sailboats, how could traders be confident that the parties with whom they were considering working on the other side of the ocean would not act opportunistically? Commercial agents overseas spared merchants time and the hazards of travel and allowed them to diversify their investments; but agents might also cheat or renege on or neglect their commitments.

My research about the merchants of Jewish origin plying the sugar trade linking Brazil, Portugal and the Netherlands demonstrates that the same merchants chose different feasible mechanisms (institutions) to curb opportunism in different types of transactions. Its main contribution is to establish a clear pattern linking the attributes of these transactions to those of the mechanisms chosen to enforce them. It also shows how these mechanisms interrelated.

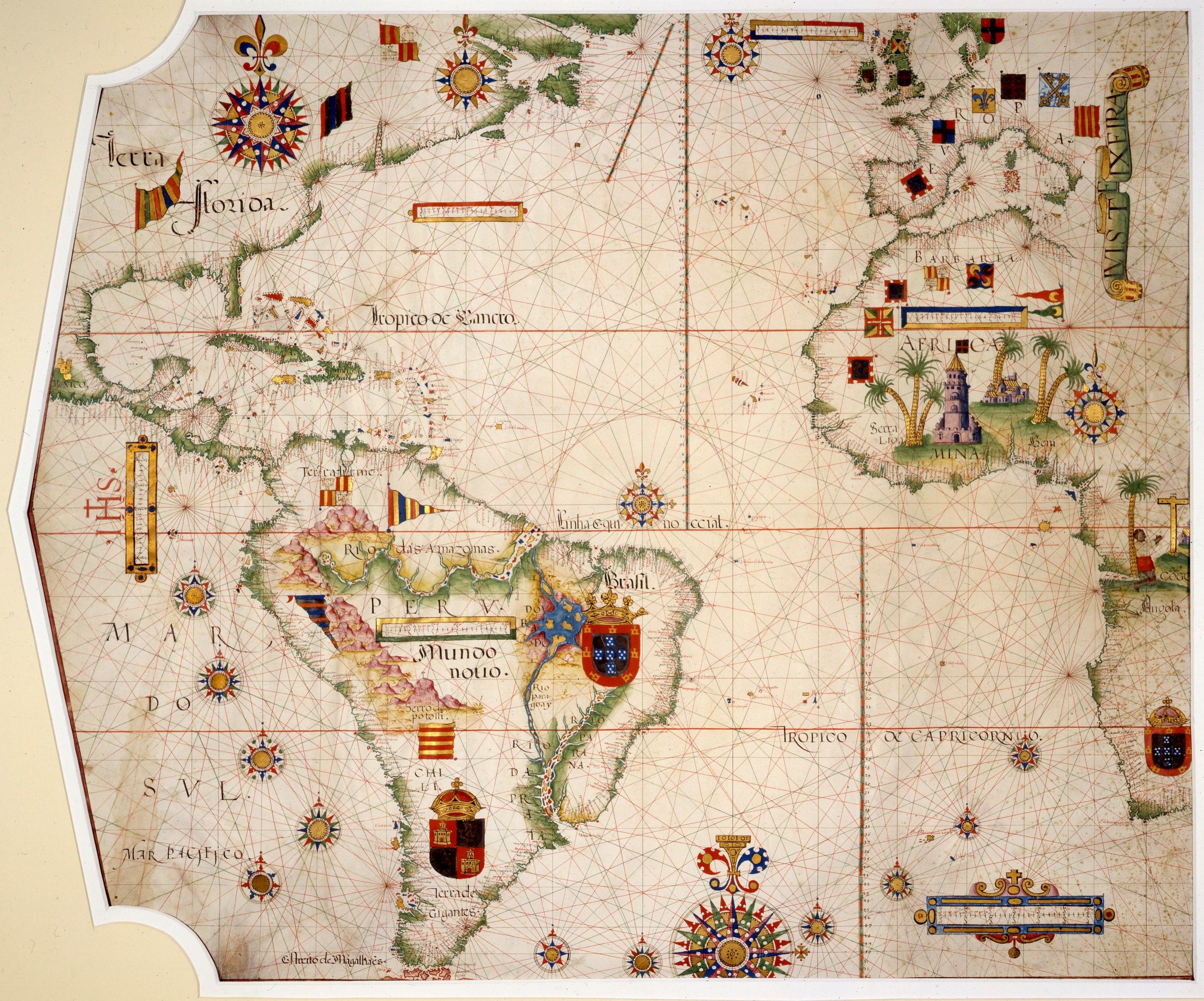

Around 1600, Europe experienced rapidly growing urban populations and dependence on trade for supplies of basic products, while overseas possessions contributed to a surging output of marketable commodities, including sugar. Brazil was turned into the first large-scale plantation economy and became the world’s main sugar producer, with Amsterdam emerging as its main distribution and refining centre. Most of the Brazilian sugar trade was intermediated by merchants in Portugal, and traders of Jewish origin scattered along this trade route played a prominent role in the sugar trade. The Brazilian sugar trade required institutions with low costs in agency services and contract enforcement because it was a significantly competitive market. Its political, legal, and administrative framework raised relatively few obstacles to market entrants, and trade in a semi-luxury commodity necessitated low start-up costs.

Sources reveal that merchants of Jewish origin engaged mostly individuals of other backgrounds in transactions in which agents had little latitude, performed simple tasks over short periods, and managed small sums (see table 1). Insiders were not left out in these transactions, but the background of agents was not determinant.The research shows that these transactions were primarily enforced by an informal mechanism that linked one’s expected income to one’s professional reputation. Bad conduct led to marginalization while good behaviour vouched for more opportunities by the same and other principals. This mechanism functioned among all traders, despite their differing backgrounds, who were active in these interconnected marketplaces. This professional reputation mechanism worked because a standardization of basic mercantile practices produced a shared understanding of how trade should be conducted. At the same time, the marketplaces’ structure together with patterns of transportation and correspondence increased the speed, frequency, volume, and diversity of the information flow within and between these marketplaces. This information system facilitated both the detection of good and bad conduct and relatively rapid response to news about it.

The professional reputation mechanism worked better on transactions involving small sums and fewer, simpler, and shorter tasks. Misconduct in these tasks were easier to detect and expose amid an extensive and heterogeneous network; and if the agent cheated, the small sums assigned were not enough to live on while forsaking trade.

Table 1. Backgrounds of agents in complex and simple arrangements

| Type of transaction | Outsiders | Probable outsiders | Insiders | Probable insiders | Relatives |

| Complex | 2.6% | 4.9% | 69.9% | 2.1% | 20.6% |

| Simple | 20.0% | 70.0% | 0% | 10.0% | 0% |

Source: original article in the Economic History Review.

On the other hand, merchants of Jewish origin preferred to engage members of their diaspora in complex, larger, and longer transactions (see table 1). A reputation mechanism within diaspora was more effective in governing transactions that were difficult to follow. Although enforcement within the diaspora benefitted from the general information system, the diaspora’s social structure generated more information more rapidly about the conduct of its members. In each centre, insiders knew each other and marriages and socialization within the group prevailed. Insiders usually had personal acquaintances and often relatives in other centres as well. They were conscious of their common history and fragile status. Such social structure also provided greater economic and social incentives for honesty and diligence than the professional mechanism, making the internal mechanism preferable in transactions involving larger sums and wider latitude.

Finally, the research shows that the legal system was able to impose sanctions across wide distances and political units. Yet owing to courts’ slowness and costliness, merchants resorted to litigation only after nonjudicial mechanisms failed. Furthermore, courts could not punish inattention that did not breach legal, customary, or contractual specifications, nor could courts reward accomplishment.

Litigation had to supplemented the professional mechanism because its incentives were not homogeneous across all marketplaces and diasporas. Courts also reinforced the diaspora mechanism by limiting the future income an agent expected to gain from misappropriating large sums from one or many principals. Finally, the professional mechanism supplemented the diaspora mechanism by limiting alternative agency relations with outsiders for insiders who had engaged in misconduct.

Because merchants were capable of matching transactions with the most appropriate governing mechanisms, they were able to diversify their transactions, expand the market for agents, better allocate agents to tasks, and stimulate competition among them. The resulting decrease in agency costs was critical in a significantly competitive market as the sugar trade. Institutional choice thus supported and reinforced—rather than caused—expansion of exchange.