It is only cheating if you get caught – Creative accounting at the Bank of England in the 1960s

by Alain Naef (Postdoctoral fellow at the University of California, Berkeley)

This research was presented at the EHS conference in Keele in 2018 and is available as a working paper here. It is also available as an updated 2019 version here.

The 1960s were a period of crisis for the pound. Britain was on a fixed exchange rate system and needed to defend its currency with intervention on the foreign exchange market. To avoid a crisis, the Bank of England resorted to ‘window dressing’ the published reserve figures.

In the 1960s, the Bank came under pressure from two sides: first, publication of the Radcliffe report (https://en.wikipedia.org/wiki/Radcliffe_report) forced publication of more transparent accounts. Second, with removal of capital controls in 1958, the Bank came under attack from international speculators (Schenk 2010). These contradictory pressures put the Bank in an awkward position. It needed to publish its reserve position (holdings of dollars and gold ) but it recognised that doing so could trigger a run on sterling, thereby creating a self-fulfilling currency crisis (see Krugman: http://www.nber.org/chapters/c11032.pdf).

For a long time, the Bank had a reputation for the obscurity of its accounts and its lack of transparency. Andy Haldane (Chief Economist at the Bank) recognised, for ‘most of [it’s] history, opacity has been deeply ingrained in central banks’ psyche’.

(https://www.bankofengland.co.uk/speech/2017/a-little-more-conversation-a-little-less-action). One Federal Reserve (Fed) memo noted that the Bank of England took ‘a certain pride in pointing out that hardly anything can be inferred by outsiders from their balance sheet’, another that ‘it seems clear that the Bank of England is being pushed – by much public criticism – into giving out more information.’ However, the Bank did eventually publish reserve figures at a quarterly, and then monthly, frequency (Figure 1).

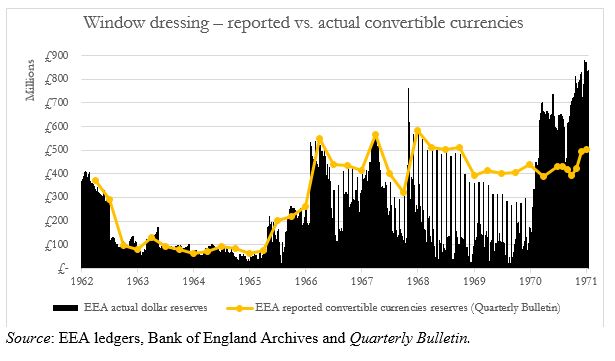

Transparency about the reserves created a risk for a currency crisis so in late 1966 the Bank developed a strategy for reporting levels that would not cause a crisis (Capie 2010). Figure 1 illustrates how ‘window dressing’ worked. The solid line reports the convertible reserves as published in the Quarterly Bulletin of the Bank of England. This information was available to market participants. The stacked columns show the actual daily dollar reserves. Spikes appear at monthly intervals, indicating the short-term borrowing that was used to ensure the reserves level was high enough on reporting days.

Figure 1. Published EEA convertible currency reserves vs. actual dollar reserves held at the EEA, 1962-1971.

The Bank borrowed dollars shortly before the reserve reporting day by drawing on swap lines (similar to the Fed in 2007 https://voxeu.org/article/central-bank-swap-lines). Swap drawings could be used overnight. Table 1 illustrates how window dressing worked using data from the EEA ledgers available at the archives of the Bank. As an example, on Friday, 31 May 1968, the Bank borrowed over £450 million – an increase in reserves of 171%. The swap operation was reversed the next working day, and on Tuesday the reserves level was back to where it was before reporting. The details of these operations emphasise how swap networks were short-term instruments to manipulate published figures.

Table 1. Daily entry in the EEA ledger showing how window dressing worked

The Bank of England’s window dressing was done in collaboration with the Fed. Both discussed reserve figures before the Bank published them. During most of the 1960s, the Bank and the Fed were in contact daily about exchange rate matters. Records of these phone conversations are parsimonious at the Bank but the Fed kept daily records (Archives of the Fed in New York, references 617031 and 617015).

During the 1960s, collaboration between the two central banks intensified. The Bank consulted the Fed on the exact wording of the reserve publication (Naef, 2019) and the Fed communicated on the swap position with the Bank, to ensure consonance between the public statements. Indeed, the Fed sent excerpts of minutes to the Bank to allow excision of anything mentioning window dressing (Archives of the Fed in New York, reference 107320). Thus, in December 1971, before publishing the minutes of the Federal Open Market Committee (FOMC) for 1966, Charles Coombs (a leading figure at the Fed) consulted Richard Hallet (Chief Cashier at the Bank):

‘You will recall that when you visited us in December 1969, we invited you to look over selected excerpts from the 1966 FOMC minutes involving certain delicate points that we thought you might wish to have deleted from the published version. We have subsequently deleted all of the passages which you found troublesome. Recently, we have made a final review of the minutes and have turned up one other passage that I am not certain you had an opportunity to go over. I am enclosing a copy of the excerpt, with possible deletions bracketed in red ink.’

Source: Letter from Coombs to Hallet, New York Federal Reserve Bank archives, 1 December 1971, Box 107320.)

Coombs suggested deleting passages where some FOMC members criticised window dressing, while other members suggested the Bank would get better results ‘if they reported their reserve position accurately than if they attempted to conceal their true reserve position’ (https://fraser.stlouisfed.org/scribd/?item_id=22913&filepath=/docs/historical/FOMC/meetingdocuments/19660628Minutesv.pdf). However, MacLaury (FOMC), stressed that there was a risk of ‘setting off a cycle of speculation against sterling’ if the Bank published a loss of $200 million, which was ‘large for a single month’ in comparison with what was published the previous month.

The history of the Bank’s window dressing is a reminder of the difficulties central banks face in managing reserves, a situation similar to how investors today closely monitor the reserves of the People’s Bank of China.

To contact the author: alain.naef@berkeley.edu

References:

Capie, Forrest. 2010. The Bank of England: 1950s to 1979. Cambridge: Cambridge University Press.

Naef, Alain. 2019. “Dirty Float or Clean Intervention? The Bank of England in the Foreign Exchange Market.” Lund Papers in Economic History. General Issues, no. 2019:199. http://lup.lub.lu.se/record/dfe46e60-6dfb-4380-8354-e7b699ed8ef9.

Schenk, Catherine. 2010. The Decline of Sterling: Managing the Retreat of an International Currency, 1945–1992. Cambridge University Press.