Uncertainty and the Great Slump

by Jason Lennard (London School of Economics and Lund University)

This article has now been published in the Economic History Review and is available on Early View

A key challenge in economic history is to understand the macroeconomics of interwar Britain. This was a time of high unemployment, depressed economic activity and significant macroeconomic volatility. Economic historians have identified a number of causes, from the demise of the old staple industries to the shortening of the working week (Richardson, 1965; Broadberry, 1986).

Yet the historiography has not explored an important source of modern economic fluctuations: uncertainty (Bloom, 2009; Jurado et al., 2015; Baker et al., 2016). A fog of uncertainty may well have hung over Britain between the wars given the volume of extraordinary events. Economically, there was the return to and break from the gold standard, the fiscal aftermath of the First World War and the slide to protection. Politically, there were snap general elections in 1923 and 1931, hung parliaments following the elections of 1923 and 1929 and national governments during the 1930s.

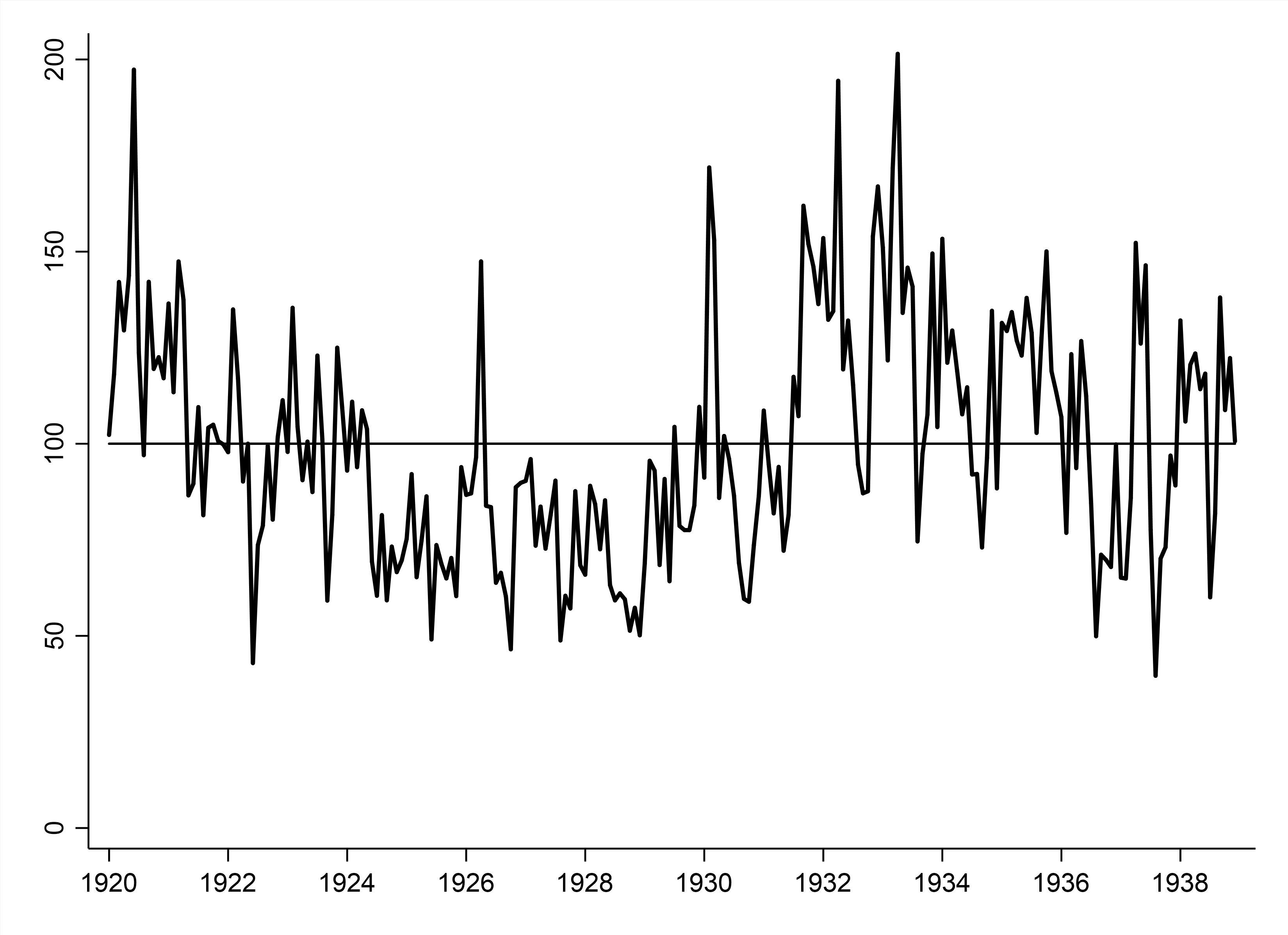

In new research (Lennard, forthcoming EcHR), I investigated how economic policy uncertainty affected the British economy in the interwar period. As a nebulous concept, the first step was to measure uncertainty. In order to do so, I constructed an index based on the frequency of articles reporting uncertainty over economic policy in the Daily Mail, Guardian and The Times (Figure 1).

Figure 1. New economic policy uncertainty index for the United Kingdom, 1920-38 (average 1920-38 = 100)

The new index is plotted in Figure 1, which shows that there was significant variation in uncertainty in the United Kingdom between 1920 and 1938. Uncertainty spiked around recurring events in the calendar such as budget announcements and general elections but also in response to more specific factors such as the General Strike, looming inter-allied debt payments and changes in the likelihood of war.

The second step was to account for the macroeconomic effects of uncertainty. Using a vector autoregression, I found that uncertainty was associated with reduced credit (a ‘financial frictions effect’), fewer imports (a ‘magnification effect’), lost jobs, and lower economic activity. Overall, economic policy uncertainty accounted for more than 20 per cent of macroeconomic volatility.

A wealth of narrative evidence backs up the significance of uncertainty shocks. At the microeconomic level, there were regular reports of disruption to a number of industries from pianos to textiles. In the car industry, for example, Sir William Letts, chairman and managing director of Willys Overland Crossley, told shareholders at the annual general meeting that uncertainty is, ‘crippling business and holding back activity and energy in our great industry’ (Guardian, 25 Feb. 1930, p. 6).

At the macroeconomic level, there were frequent descriptions of depressed employment and output. In 1920, for example, the Daily Mail (30 Dec. 1920, p. 4) reported that, ‘among the main causes of unemployment at the present moment […] is uncertainty in the business world’. In 1930 Sir William Morris wrote that Britain was ‘floundering in a sea of uncertainty […] the result being colossal unemployment’ (Daily Mail, 29 Aug. 1930, p. 8). In 1932 the Economist (30 Jan. 1932, p. 1) summarised that ‘business this year has been overshadowed by the economic and political uncertainty at home and abroad’.

In summary, uncertainty has been a forgotten, albeit incomplete, explanation for macroeconomic instability in interwar Britain. How uncertainty affected economies in other historical contexts is an important and open question for future research.

To contact the author:

Email: jason.lennard@ekh.lu.se

Twitter: @jason_lennard

References

Baker, S. R., Bloom, N., and Davis, S. J., ‘Measuring economic policy uncertainty’, Quarterly Journal of Economics, 131 (2016), pp. 1593–636.

Bloom, N., ‘The impact of uncertainty shocks’, Econometrica, 77 (2009), pp. 623–85.

Broadberry, S., The British economy between the wars: a macroeconomic survey (Oxford, 1986).

Jurado, K., Ludvigson, S. C., and Ng, S., ‘Measuring uncertainty’, American Economic Review, 105 (2015), pp. 1177–216.

Lennard, J., ‘Uncertainty and the Great Slump’, Economic History Review, (forthcoming).

Richardson, H. W., ‘Over-commitment in Britain before 1930’, Oxford Economic Papers, 17 (1965), pp. 237–62.